Value Added Tax (VAT)

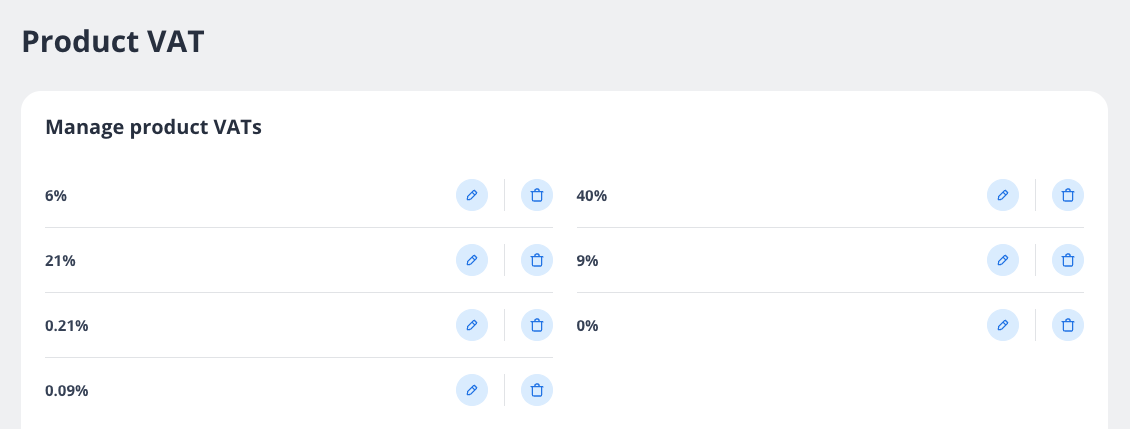

Navigation: Products → VAT

Your cash register is equipped to handle VAT (Value Added Tax) rates efficiently, allowing you to assign, modify, and manage these tax rates directly within the system. This functionality supports diverse tax requirements for your range of products and ensures compliance with local tax regulations.

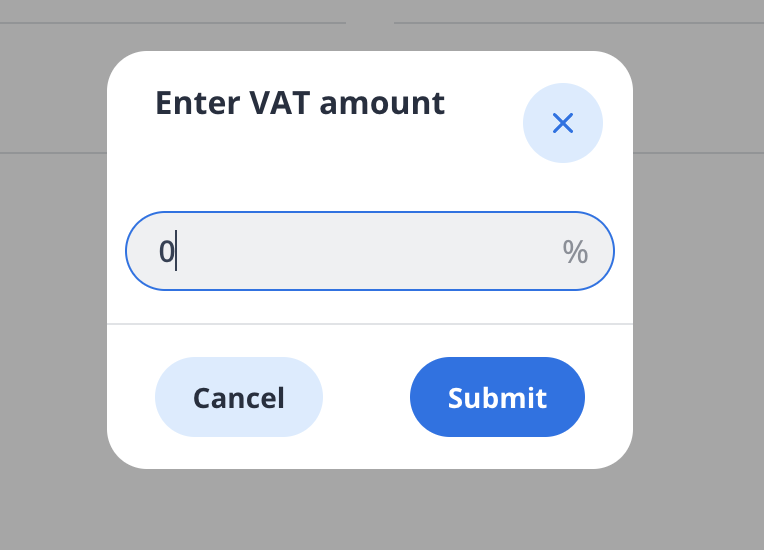

Add VAT

You can add VAT rates by navigating to the "Manage Product VATs" section of your cash register's interface. Here, you'll find an option to enter new VAT percentages, such as 21%, 10%, or 0%. Adding these rates is essential for accurately representing the tax obligations on different types of products, whether they are standard-rated, reduced-rated, or exempt.

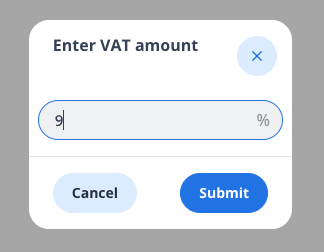

Update VAT

To update existing VAT rates, locate the particular percentage in the "Manage Product VATs" list and click on the pencil icon to edit it. This feature is particularly useful when tax regulations change or when a correction is needed due to previous inaccuracies. Keeping this information up-to-date is critical for maintaining compliance and minimizing errors in tax collection.

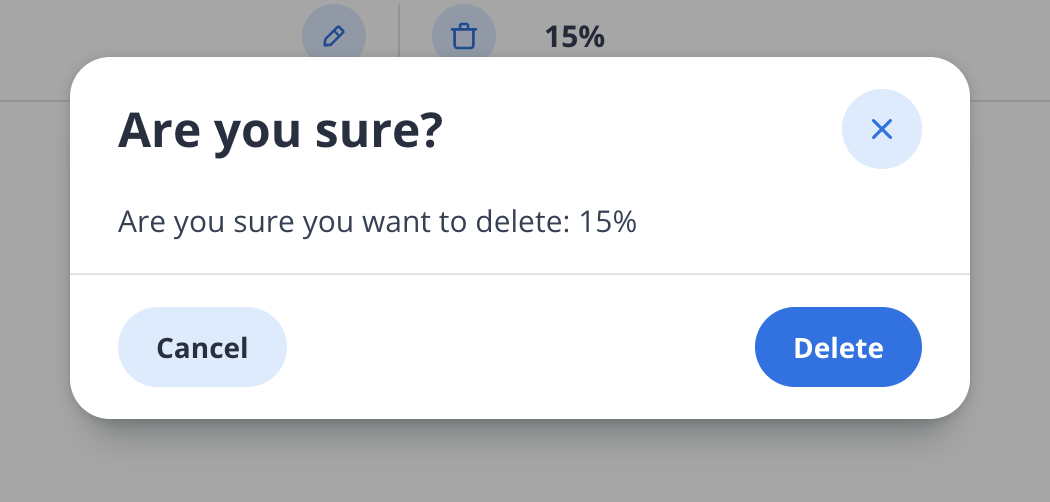

Delete VAT

If certain VAT rates are no longer applicable or needed, you can delete them by selecting the trash bin icon next to the rate in the "Manage Product VATs" section. Removing outdated rates helps to streamline your system and ensures that your cash register displays only relevant tax information.

Assign VAT to product

Assignment of VAT to a product is described in Products